IOR Service

ACP Service

IOR Service

ACP Service

Import your products with our ACP and IOR services

Read More

Read More

Making The Japanese Market Accessible To You

Grow Your Customer Base With The 3rd Largest Ecommerce Market

Grow Your Customer Base With

The 3rd Largest Ecommerce Market

The 3rd Largest Ecommerce Market

ECOMMERCE MARKET

Read More

Read More

Optimize Your Offerings For The Japanese Audience

IOR Service

ACP Service

IOR Service

ACP Service

Import your products with our ACP and IOR services

2013

Year Established

500

+

International Brands

$ 7.68B

Client Annual Japan Revenue

Who We Are

Purpose & Passion

We connect global businesses to the Japanese market by serving as a local operating partner, providing End-2-End Japan Market Entry Services, and offering bilingual support to streamline business processes.

COVUE stands for CO – joint or shared and VUE – vision.

Our company name reflects our commitment to aligning ourselves with the vision and goals of our clients as true partners, rather than mere outsourced service providers. We prioritize building strong, collaborative relationships with our clients, aiming to become an integral part of their business family while also welcoming them into ours.

What We Offer

Services

Logistics & Warehousing

Our effective fulfillment services can streamline the market entry process of Japan

Logistics & Warehousing

Our effective fulfillment services can streamline the market entry process of Japan

Customer Support

From pre-market entry to post-sales support, we ensure the success of a business in Japan

Whom We Help

Industries We Help Enter Japan

Our experience in these and many other industries helps us deliver innovative market entry solutions.

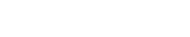

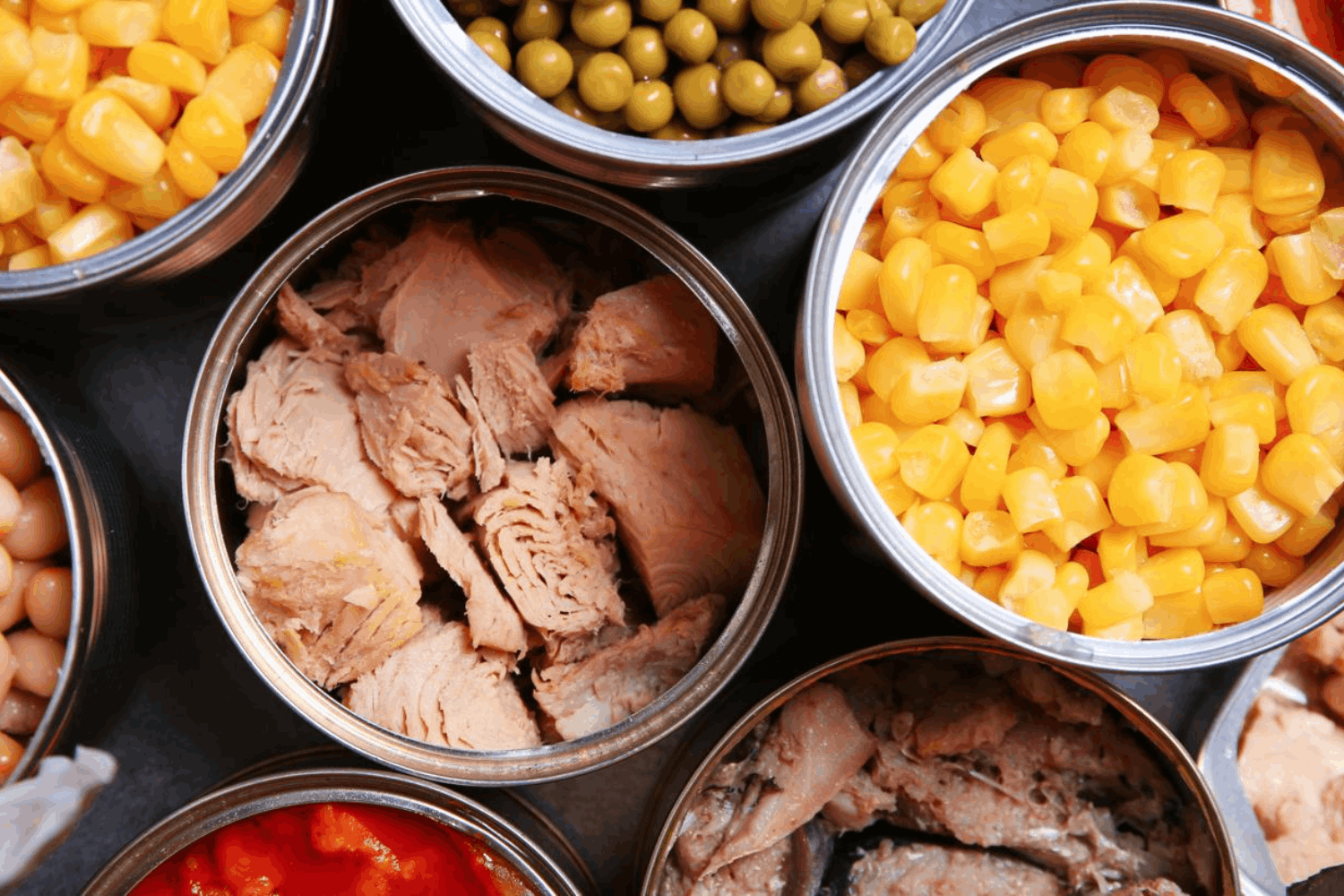

Food

Tap into Japan's vibrant food industry with our expertise in food import and distribution

Food Apparatus

Bring culinary creations to Japan with our innovative and cost-effective services

Cosmetics

Make a splash into the world of Japanese beauty, confidently

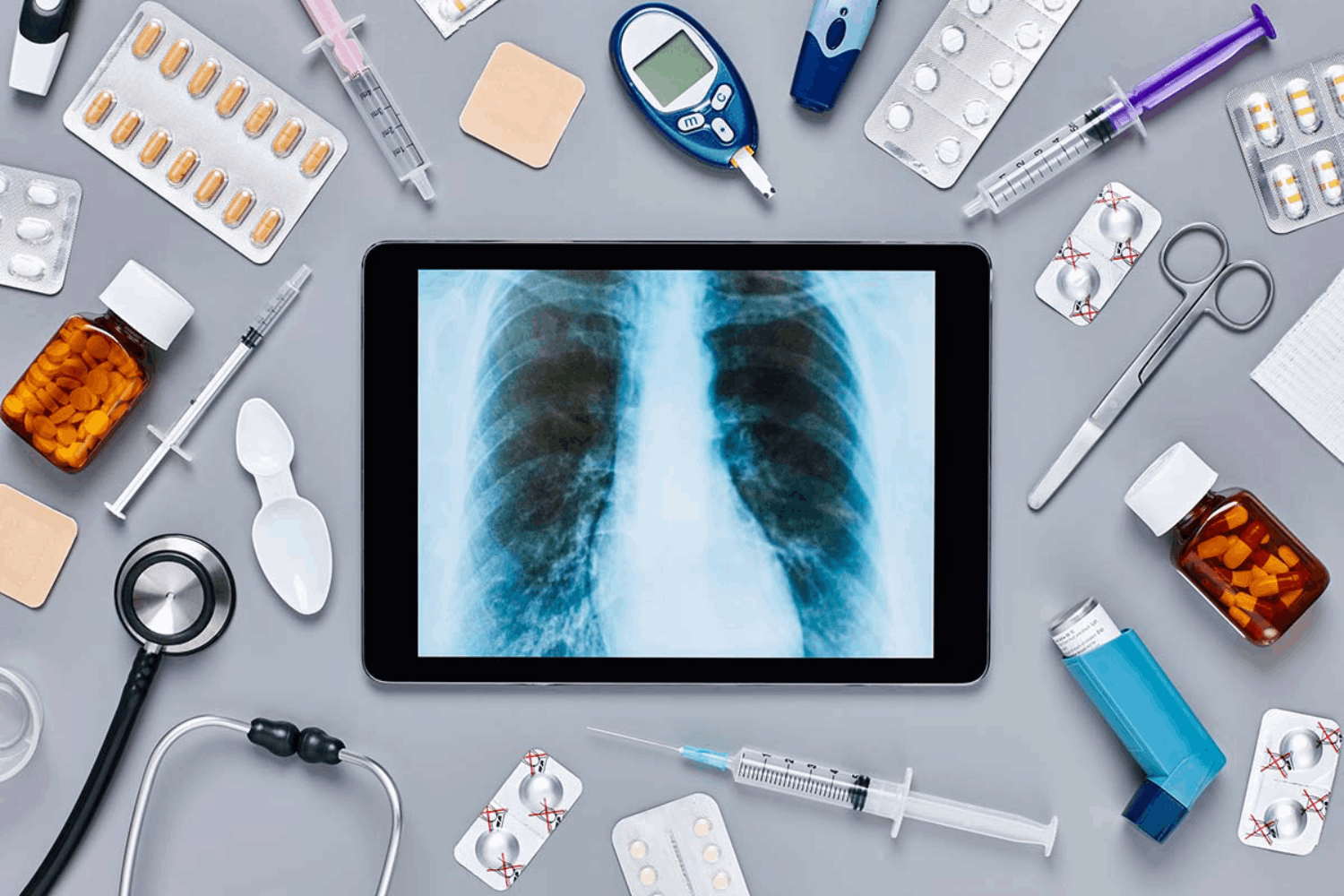

Medical Devices

Expand medical device business into Japan's thriving healthcare market with ease

Electronics

Plug into the possibilities of Japan's electronics market with cutting-edge solutions

Quasi-Drugs

Navigate Japan's regulated Quasi Drugs market for long-term success

Fashion

Get ahead of the fashion curve with international flair in Japan

Shelf Stable Food

Satisfy Japan's appetite for shelf-stable foods with expert guidance

How We Work

Approach

01

Discovery

Understanding your company and business goals

02

Proposal

Developing a market entry plan based on your goals

03

Strategy Development

Exploring avenues for business expansion in Japan

04

Execute

Providing executable business solutions to ensure success in Japan

05

Support

Evaluating the strategy and providing necessary support

Partners

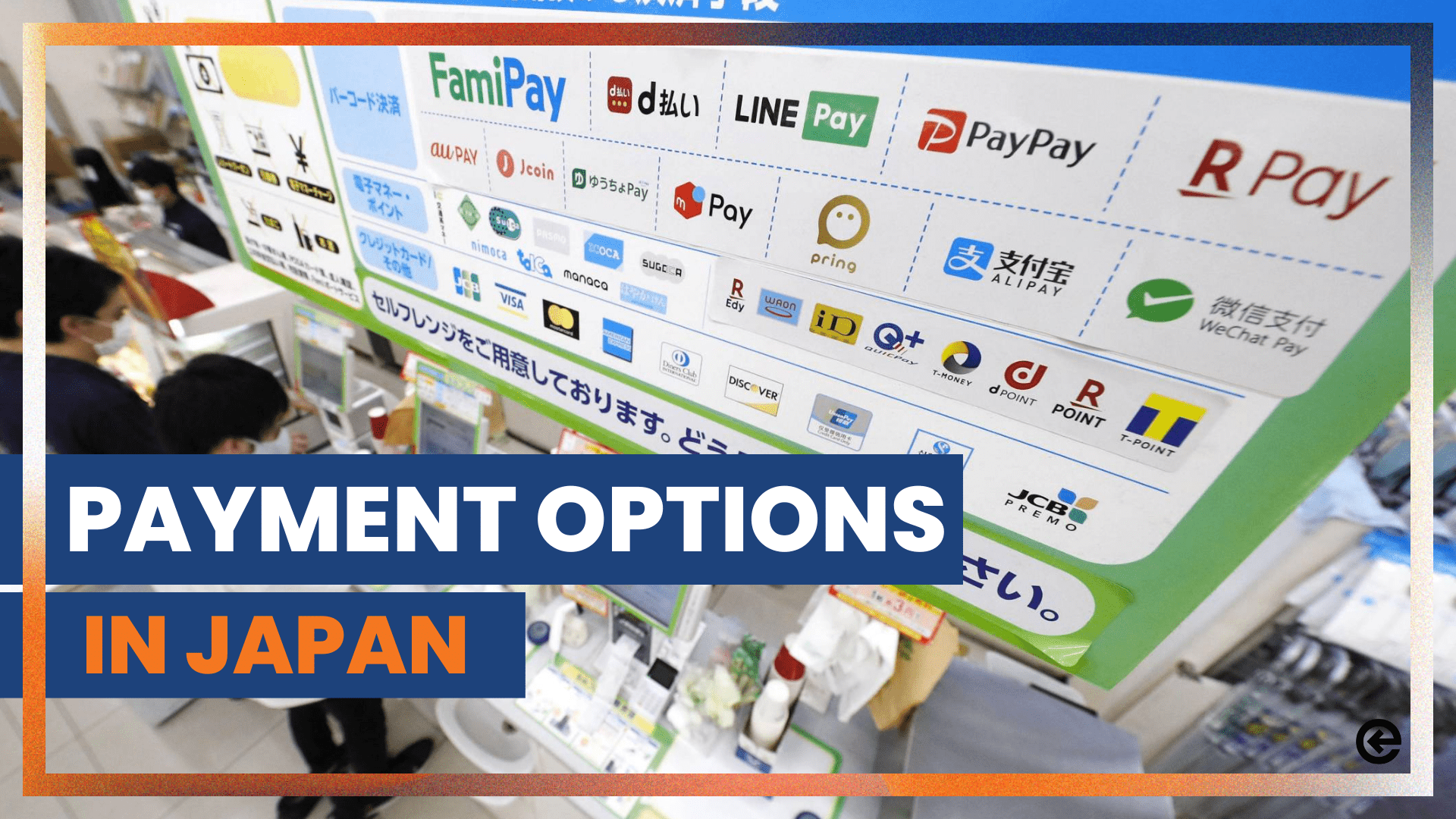

Japan Business Insights

News & Articles

Stay up-to-date with the latest trends and insights in Japan

Ready to take your Business to the Next Level?

Subscribe to our Newsletter

|

|

Thank you for Signing Up |